Welcome to the edition #2 of Mondays in Metaverse.. Technically, I have written more posts on the topic but that was before the newsletter. Anyhow, the topic for this week is Web3.

Have you come across the term Web3 or Web3.0 recently and are wondering what is it? In this post I will try to explain what Web3 is and what problems is it trying to solve from Web2.

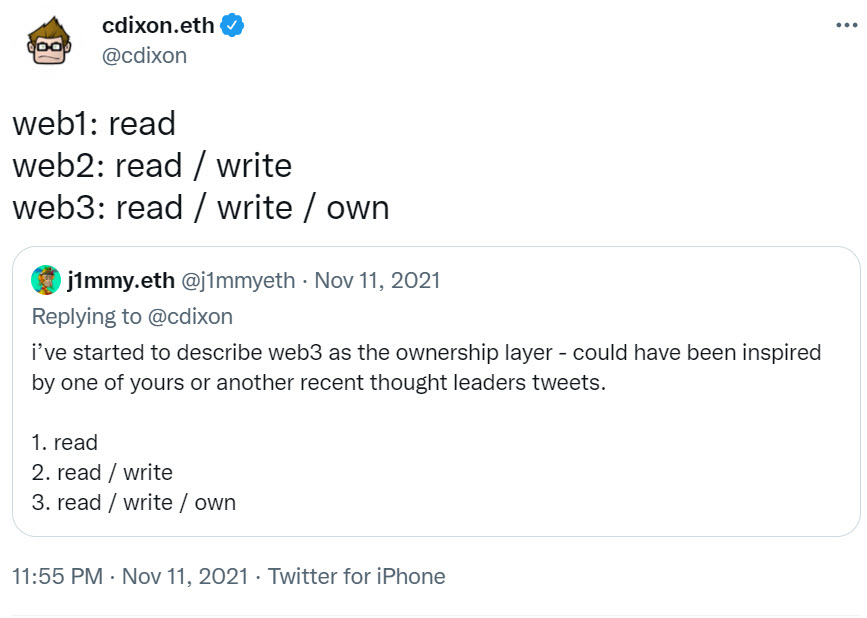

The best definition of Web3 that I have come across is by Chris Dixon – who is a famous VC at Andreessen Horowitz

So let’s dig in a bit deeper into what these terms Read, Write, Own mean and how they relate to the different eras of the Web.

Each era of Web has been quite revolutionary and has opened up opportunities that were not possible before. At the same time, each of these eras had some problems which eventually led to a newer players coming in and shaping the next era of the Web.

Web 1 – Read-only

Timeline – 1990s to early 2000s

This is when the web was primarily bunch of static web pages linked to each other via hyperlinks. This was the time when AOL, Yahoo etc were popular. Even Google was found in this era.

Many people call this as the Golden age of innovation, as the internet was open. There were open protocols – TCP, IP, HTTP, SMTP – that you could build on and no one owned those protocols. So as a developer, founder, creator you were controlling your own destiny.

This was revolutionary at the time, as now you could put your ideas out in the world without anyone’s permission. Before Web1, to put your ideas out there you would need to either be on a radio channel or TV or newspaper which were all controlled by large corporations and thus controlled by them.

This was also the era of biggest %age growth of internet users.. Internet users went up from 16 million in 1995 to 700 million in 2003 (data source). A whopping 4200% increase in less than 10 years, but it was still a very tiny percentage of world’s population

Challenges with Web1

There was a big challenge, that these open protocols weren’t easy for everyday users to interact with and the functionality was limited. To build a website and put your ideas out there you would need to buy a domain name, set up web hosting, create a webpage with html, css etc.

Let’s just say the user experience of Web1 wasn’t great and the functionality was quite limited.

Web 2 – Read and Write

Timeline – mid 2000s to current

Web2 solved the UX challenge of Web1 and made it really easy for people to come online and express their ideas.

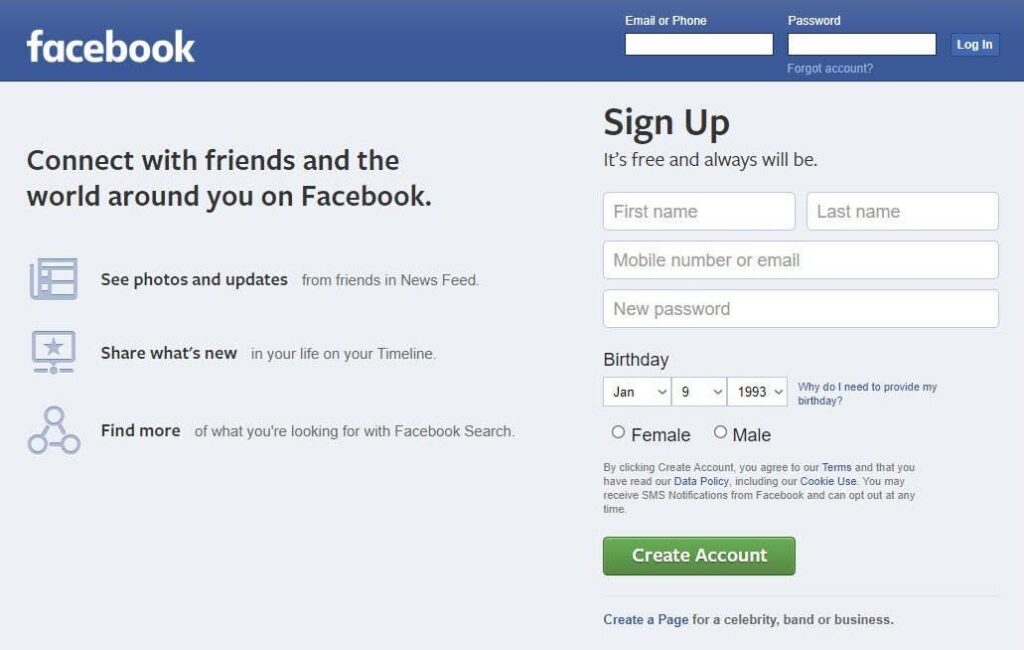

With Web2 you didn’t need to buy a domain name, you didn’t need to buy web hosting. You just needed to create a Facebook, Twitter, LinkedIn account and you would get your page. It was much easier..

And of course, if you are reading this you know that Web2 was a big success. In terms of absolute numbers, we grew from 700 million in 2004 to more than 5 billion internet users in 2021. 4.3 Billion people have come on the internet during the Web2 era and know the Facebook, Google, Instagram, Whatsapp, Youtube as the internet.

This is the era of the user generated content and also the era of losing user privacy.

When I say user-generated content, I mean it to be much bigger than just posting status updates. If you think about it majority of internet today is based on user generated, user owned content and the sharing economy.. Let’s take some examples

- Facebook, Twitter, LinkedIn – user generated posts/status updates

- Instagram, Snapchat – user generated photos

- YouTube – user generated video

- Airbnb – user hosted stays / user rented properties

- Uber – user driven cars

- Spotify – user (artist) generated music

- Apple Appstore or Google Playstore- user created apps

- Even marketplaces like Amazon, Ebay – user selling their stuff to other users

The question to be asked though is that who captures most of the value generated from this user content – the users or these large platforms?

Challenges with Web2

The success of Web2 is obvious from the sheer number of people online today. But this has also come at a cost – we have moved away from open protocols to closed ecosystems.

As a creator in these closed ecosystems, you don’t own your audience. With open standards such as SMTP for email, you are free to choose which newsletter service you want to use. If you are unhappy with one, you can switch to other and still retain your audience. But with a closed ecosystem like Facebook, Twitter, LinkedIn, YouTube you can’t switch platform and have the same audience elsewhere. If any of these platforms decides to de-platform you, you can lose your audience built over years in seconds.

These closed ecosystems have led to various monopolies or oligopolies, which means more power in hands of few and far lesser competition. All of these companies are networks of some sort, each new driver on Uber makes the value of Uber more lucrative. These network effects give these companies strong economic moats and make it really hard for competition to survive. Did you try to switch from Whatsapp to Signal when the privacy policy updates were being pushed? How successful were you? How many message did you send on Signal last week? That’s the power of network effects.

As a result, we have huge internet giants that capture most of the value that internet is generating. Even though the most of the value is being generated by the users, but the value is being captured by these large platforms. This is why we see so many developers fighting against Apple for taking 30% of the AppStore fees. YouTube keeps a much bigger cut of the revenue than it shares with the creators. On Spotify, the artists make very little even though they may have very passionate fan base. Early drivers on Uber or Early hosts on Airbnb had outsized contribution to the success of these companies but the $70 billion market cap of Uber didn’t change the lives of those drivers significantly.

Not just that, this centralization has also led to number of privacy issues being surfaced. How many of you have had an experience of talking about something to your friend and seeing a Facebook ad the next day? The business model of free Web2 has led us down the rabbit hole of collecting all data (often without consent) at all cost, and using that data to push ads. Isn’t it strange that the goals of some of the best minds and smartest people of our time is to show more ads?

In short, the issue with Web2 is that it is centralized, controlled by a few giants and we have privacy issues.

Web3 – Read, Write, Own

This leads us to Web3. The big difference in Web3 is that now the users of the network can own the network without the intermediary of the “company”. Imagine, Airbnb where the guests and the hosts are part owners of the network. Uber where drivers and passengers own and help build the platform.

Blockchain technology enables the ownership of the internet, thus enables Web3.

I talked about Bitcoin in my last post. Bitcoin is also a network, it is a network of money. Thanks to blockchain technology, it is owned by the participants on the network. There is no Central Bank that owns or prints or issues or tracks Bitcoin.

In Web3 internet services are owned and controlled by the users, creators, developers. This ownership and control is managed via Tokens issued by the network. The control is managed by Decentralized Autonomous Organizations (DAOs) based on voting done by the token owners. These tokens can be fungible (Bitcoin, Ethereum) or non-fungible – NFTs (unique items – art, music etc).

The tokens help align incentives, as all the token holders have a common objective which is to ensure the success of the network which could be by adding new features, onboarding new users etc. Tokens also provide a good way to break the network effects of current centralized companies by providing incentives to the early users.

Identity also works differently in Web3. You don’t use user-ids, password, date of birth, SSN etc to log in to a central server. Your data is stored on the chain, No central organization is storing your data. This gives you more control over your data, and you can choose what access to grant to who using your private keys using your Wallet such as Metamask. You can choose to share different information with different applications based on the utility.

To summarize, Web3 brings us the open protocol standards of Web1 and without sacrificing the functionality and user experience of Web2. It puts the control of the internet back in the hands of users, creators, developers and out of the hands of few tech giants.

You can already see this happening – many artists are able to directly connect with their fans and make more money than they have ever made in their lives selling NFTs. This 14-year old sold 8000 NFTs for over $1M and donated $100k of that for Beluga Whale Conservation.

Decentralized Finance (DeFi) is disrupting traditional finance such as Banks, Insurance companies etc and enabling peer to peer borrowing, lending and providing much better interest rates.

It is still early days for Web3. It is just the beginning. The future is web is being created right now and I am excited about it.

Next

I dropped a bunch of terms in the post such as Blockchain, NFTs, DAOs, DeFi etc. Please comment and let me know which ones you would like to me to cover and explain in the upcoming posts.

If you would like to get this post as an email in your Inbox, you can sign up for my newsletter here.