Subscribing and Forgetting is Costly

How many times in this past year did you sign up for a subscription service looking at the free trial and then forgot to cancel when the trial ended?

Many times when new services are launched, companies will make an enticing trial offer to you to sign-up with for 7-days, 15-days, 90-days, with the hope that you would either get so used to the service that you will sign-up as a paid member or be too lazy/forget to disconnect. It is quite possible that you are paying for one already that you are not actively using today.

With Software as a Service (SaaS) becoming the norm in the software world, more and more applications are moving their licensing models to recurring per month charges. This applies to a number of services that you may be using already –

- Video streaming services — Netflix, Youtube Premium, Disney+, Hulu, Prime Video…

- Audio streaming — Spotify, Pandora, Youtube Music, Amazon Music etc.

- Books/Audiobooks — Audible, Kindle Unlimited etc.

- Health/Fitness services — Headspace, Calm, Fitbit Premium etc.

- Productivity software — Office 365, Google Suite, Notion, multiple Task Managers etc.

- Learning — Coursera Plus, Udacity, LinkedIn Learning (Lynda), Skillshare etc.

$10/month may seem quite harmless, but it quickly adds up $100 — $150/month with multiple different services. Combined, you could be spending hundreds of dollars every month on these. Keep in mind the above list is not even close to the complete list of categories in personal space and I haven’t gone into the subscriptions that you may be using for managing your business.

CoronaVirus Impact

Due to lock down enforced by CoronaVirus a number of services have come out and are very genuinely looking to help people with free one-month, two-months trials. These could be very useful if you are looking to utilize the new found time that you may have at your hands (assuming you don’t have little kids like me, in which case I empathize with you :P).

But at the same time, there’s an increased realization that you shouldn’t be overspending and saving every bit you can for the tough times ahead.

So even though there are many apps in Learning, Productivity, Meditation, Audio Streaming, Kids Education categories that are offering free services, the fear of forgetting to cancel may be holding you back from signing up for something interesting and possibly life-changing.

To remember — Don’t trust your brain

I’ve been using a rather simple solution using my Google Calendar that has helped me get the best of both worlds i.e. try out new services, and always remember to cancel on time.

Those who know me well, know that I’m a forgetful person, so I believe that if this system has worked for me it would work for you as well.

This system has been built using some trial and error and in its current form it is quite fool-proof (at least if the fool is me).

Basic idea is that you can’t trust your brain to remind you to take action on time. If you try to keep such a thing in your head, one of these two things is likely to happen:

- You will carry this load on your mind throughout the day/week/month and that’ll lead to unnecessary stress.

- Your brain will remind you of the task at the most inappropriate time e.g. just after you lie down in the bed and are ready to doze off.

As the author of Getting Things Done, David Allen says, “Your mind is for having ideas, not storing them”. The idea is to externalize your memory by using a Calendar and setting up the reminders in a particular way.

Detailed Setup — Step by Step Guide

Tools: Google Calendar

I’m using Google Calendar for this system, you might as well use any other calendar. The are two major benefits I see with Google Calendar –

- I can set up multiple reminders — multiple emails, multiple push notifications — which I haven’t seen in Outlook or iOS calendars. The more reminders the better in my case.

- It is cross-platform, I use windows laptop, android phone and an iPad. I need a system that works across devices so that there’s no friction when I am setting up the reminder and I can be notified on all devices, when receiving the reminder.

Process:

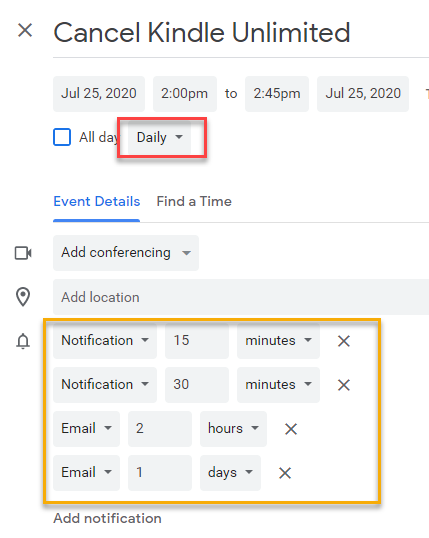

- The moment you sign up for a service, you need to set up a reminder to cancel it. I create this as an event, and not just any event, but a recurring event with a frequency of “Daily”. This is the reason why “cross-platform” is important, you need to be able to set this reminder in the moment, if you delay it you’ll forget it.

- The event needs to be set up for the day that is typically 7–10 days before you need to cancel. For example, if I got 3-months Kindle Unlimited free today i.e. 3rd May, I’ll set a reminder to cancel it from 25th July onwards

- Time of the event isn’t that important, but you can choose one when you think you’ll be most likely to act e.g. 9 AM or 5 PM.

- Setup multiple notifications to remind you of the event. I use two email and two push notifications. This way I get the task in my email + on my cell phone as well.

- Let’s say it is 25th July now, you will start getting reminders to cancel the service, but given you are very busy it is quite likely that you may ignore these reminders when they first pop-up. This is where the beauty of recurring “Daily” reminders comes in. Even if you forget to cancel the service the first day or two, you will find time to cancel the service eventually.

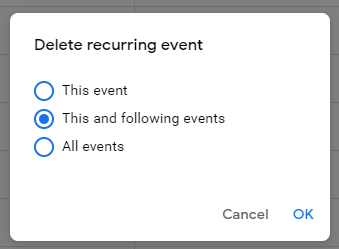

- Once you have taken action, now it is time to remove the reminders and clean up your calendar. I tend to go to the calendar of that day and delete the event using “This and following events”. This way the reminders are gone, and I also have a history of when I took the action, in case I need to go refer to it again.

So that’s the simple workflow you can use to stay on top of your subscription trials.

Credit Card Cashback — Use Case

As a Product Manager, I can’t avoid thinking in terms of use-cases.

There is another use-case where I have been able to successfully use the slightly modified form of the above system to set up reminders in order to help save $$$.

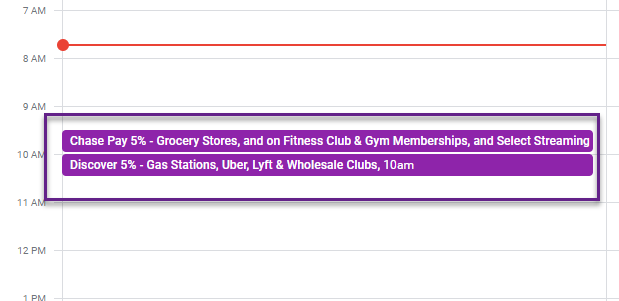

In US, many credit card companies offer 5% cashback on certain categories but these categories will change every quarter. Discover will give you 5% cashback on Amazon Oct — Dec but Chase will give you 5% Jan-March. The hope from credit card companies is that you will start using that card more often and forget which categories you signed up for.

In order to maximize the savings you can set up recurring reminders as described above with a slight variation. For this use-case, instead of daily events I use Weekly events.

When I get the email that here are the categories for this quarter, I open my calendar and set up an event recurring on every Sunday 11 AM with the title such as Discover 5% cashback — Gas stations.

I don’t need to set up any reminders for this, as I don’t want to remember this information.

Now the next time I am at the Gas station, all I need to do is pull out my phone and check Sunday’s calendar which will tell me to use Discover to get the maximum cashback.

Again, these may not be huge amounts per transaction. The difference in 1% cashback and 5% cashback on a $50 transaction is only $2.00, but depending on your credit card spend over the year it could add up to hundreds or even thousands of dollars.

Bonus Use-cases:

- Annual Health Checkups

- Doctor or Dental appointments

- Annual Free credit report

- Return Library Books

- Monthly review/reflection reminders

- …

I hope you find this system of setting reminders useful. If you know of other use-cases where this system could be handy or have come up with some creative hacks that you think I could benefit from, please do share in the comments.

Originally published at https://www.linkedin.com.